This is Lesson #1 from the «Beginner to Trade Master«: in this FREE course we are going to teach you ALL the information you should know to become a Trading Expert.

We will give you important tips we have learned by years of trading experience.

Today you are going to see Everything You Need To Know About Support & Resistance – Supply & Demand.

Those concepts works in ALL type of Markets: Stock Markets, Forex, Bitcoin, CryptoCurrency… Suitable for Scalping or Long Term Trading.

Essential Points: (Keep this following information for daily use)

Here we are going to summarize all the Trading Strategies you can use, using those levels. (Check the video for more details)

Take Profit:

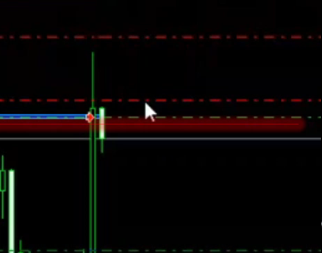

– Set your Profit Target some pips before the target level, you are more likely to touch it, because the price wants to test that level.

Stop Loss:

– Set your Loss Target some pips after the target level, you are less likely to touch it, because the price will find resistance crossing that level.

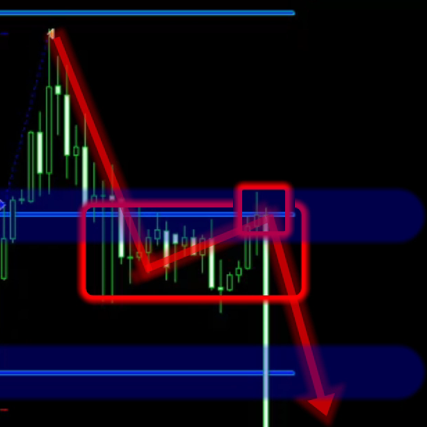

– Trailing Stop Loss: Modify your Stop Loss from one level to another level to protect your earnings and to catch big movements.

Start Trades:

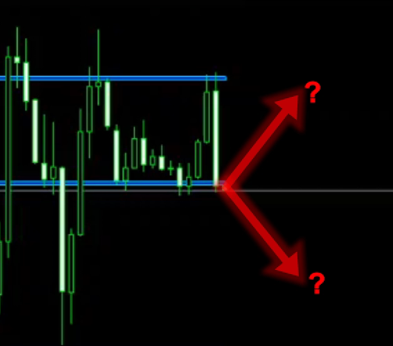

When the price approaches or touches the level, you are in the Perfect Price to start one trade. We have 2 posible scenarios: Reversal or Breaking

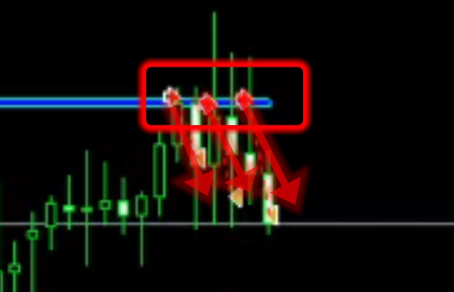

Reversal:

As long as the level is not fully broken, reversal is possible. Your trade will have 2 important factors in your favor:

– You are in a good price Selling at Higher Prices and Buying at Lower Prices

– The market often prefers to stay inside certain zones, so some type of reverse movement when approaching those supports and resistances is always present

– You can use the 2 reasons above to gain some pips with Scalping

– If you don’t want to Scalp, you can still use this concept to modify your Stop Loss to Breakeven to ensure your order is fully protected

The only downside is than by definition of reversal you are trading against the local trend, expecting and anticipating the change of the trend. And trading against the trend always comes with his own risks; but if you set your Stop Loss correctly as we explained above your trade should be safe.

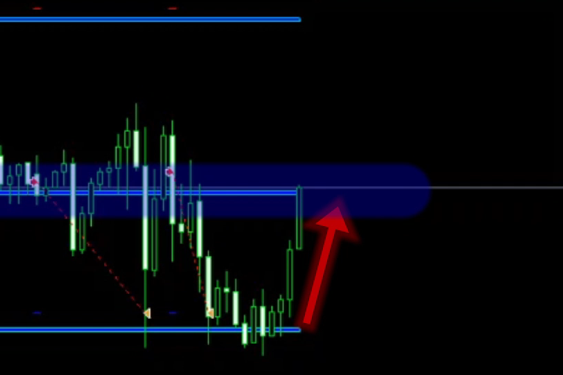

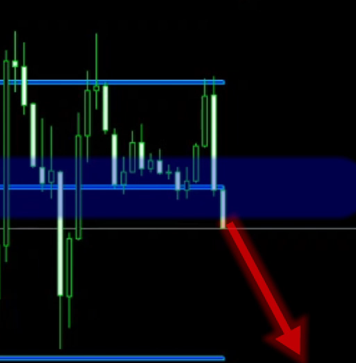

Breaking (continue the Trend):

Breaking the level consolidates the continuation of the trend. Here there are the market signals to anticipate the break:

– When the Price keeps testing and approaching the level, it means the break is unavoidable.

– You can also expect the break of the level when the market approaches with a lot of momentum

– When the price fails to reach the contrary level it’s also a clear sign than this contrary movement is losing strength, so breaking the next level is very likely.

Extra Tip! Breaking + Reversal: If you miss the breaking point, you don’t need to rush to enter in the trade. Most of the times, prices normalizes before continuing with the trend and gets back to the level. This is your best opportunity to get the best entry price and increase your profits.

Low Risk = High Reward:

When you are using those levels to start your trades, if you are confident the price is going in your direction, you can set your Stop Loss only a few pips bellow or above the same level. Your potential profit will be Much Higher than your possible losses. The odds will be in your favor.

Confirmation:

For both directions, if you are uncertain of the direction of the market and you want to increase the odds of your trades, after the touch of the level, you can wait certain pips to confirm your direction.

Programs used in this lesson:

If you enjoyed this lesson and you want to see more, please share this blog and our youtube video!

Feel free to contact with us, with your questions and your request! Your opinion is important for us!

Thank you everyone for watching and see you next time.

1 comentario

your code of destiny · 12 abril, 2025 a las 1:15 pm

I am extremely inspired along with your writing skills as smartly as with the layout to your weblog. Is this a paid subject matter or did you customize it your self? Either way stay up the excellent quality writing, it is uncommon to look a great blog like this one today!